TUYNHUYS

Tuynhuys is a futuristic new apartment block in Cape Town’s old legal district – replacing a faux Cape Dutch utility building whose false provenance scared off other would-be developers.

Set in a stoic row of Victorians, this exuberant high-rise proves that modern innovation is possible, and desirable, in even the most sensitive locations. Whilst the playful new tower respects its neighbours, it is no shrinking violet and its svelte muscular curves aim to be at least as attractive as its surroundings.

Read the full article here | Architect and Builder | September 2020

Willbridge Property Company appointed on Tambo Springs Logistics Gateway – South Africa’s largest in land Port

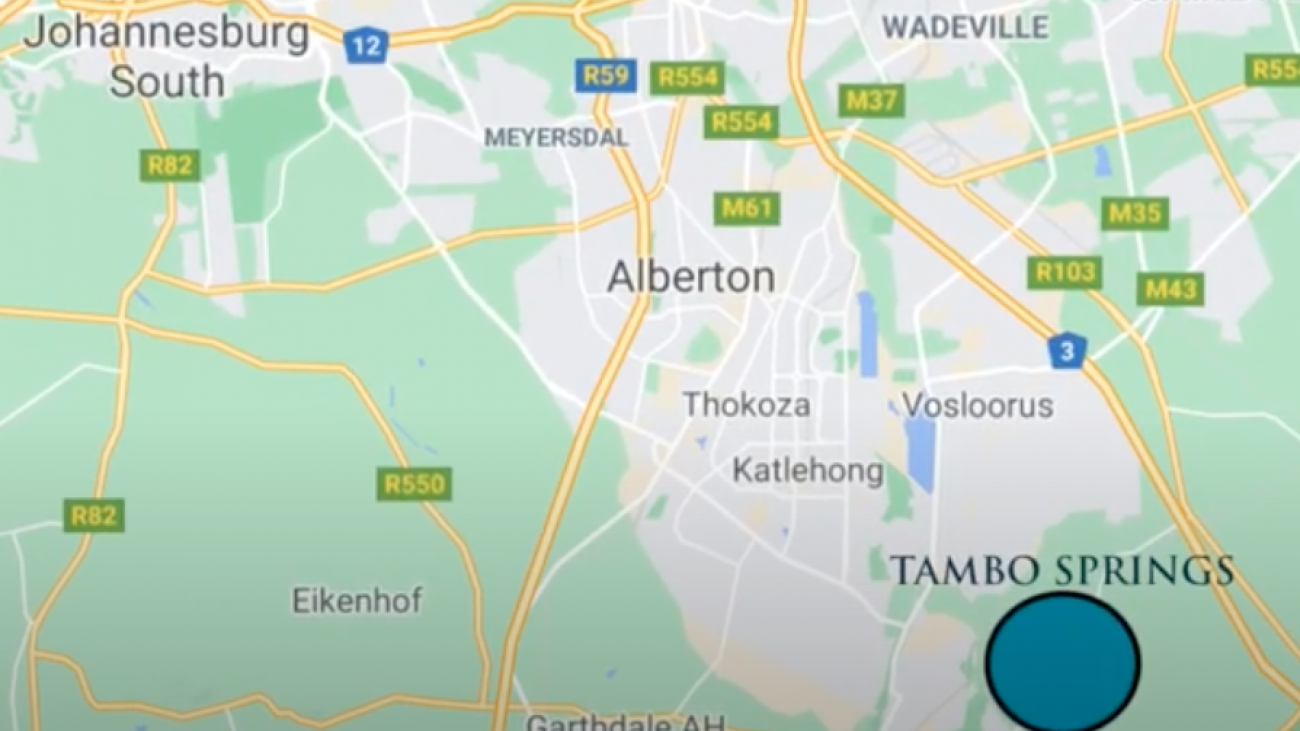

Willbridge Property Company have been appointed as Sales and Marketing Consultants by the Tambo Springs Development Company (TSDC). The role will encompass Marketing, Stakeholder Management, Communications and Sales Strategies for the incredibly visionary project, Tambo Springs Intermodal Inland Port.

Tambo Springs Logistics Gateway is a 600ha industrial development located in the southern periphery of Johannesburg/Ekurhuleni and within the Johannesburg/Durban/Coega/Cape Town road freight and rail corridor. This world-class development will bring together all aspects of the warehousing, distribution and operation efficiencies. All of this being spearheaded by the development of the Tambo Springs Intermodal Terminal.

From the ports to rail, road or air, to the warehouses and finally to the customers, Tambo Springs will be equipped to meet all manufacturing and distribution needs, Tambo Springs will nearly double current freight logistics capacity in and out of Gauteng by incorporating a range of elements which will differentiate it as a world-class competitive location.

Willbridge, have the experience and track record to orchestrate the launch and creation of this mega property development. Tambo Springs will change the way in which logistics and intermodal transport works in South Africa and with its neighbouring countries.

Their first task will be to engage with industry stakeholders and prime end users in the shipping, freight and logistics world. Managing this database of potential users will lead to the right mix of companies to be part of the new Intermodal Port. Included in the scope or work, is for Willbridge to ensure that Tambo Springs is developed as a “smart precinct”. It will offer road, rail, air and sea distribution opportunities with a private rail siding, customs clearance and special SEZ tax relief zones.

The Entrepreneur Series: Viv Delbridge and Brent Wiltshire – Willbridge Property Consultants

Belmont Asset Management continues its series of interviews with successful South African entrepreneurs. This month we feature Viv Delbridge and Brent Wiltshire, the founders of Willbridge Property Company.

Q1: Tell us about your business and the industry in which you operate.

WE are a property transaction and investment company targeting corporate clients across all property sectors. We focus primarily on reviewing property or property portfolio needs, developing a strategy and concluding transactions to buy, sell, let, sub-let or finance accordingly.

We use a range of strategic partnerships within the property sector (relating to finance, development, valuation, space planning, research, facilities management, feasibilities, etc.) as well as our extensive property networks to create the solutions to our clients’ diverse property needs.

Q2: Tell us about the motivation behind the original idea and any major milestones.

All organisations are faced with major property deliberations and decisions as they grow., consolidate or merge. Decisions around the physical environment in which businesses operate (leases, property investments, space requirements, location, facility management, etc. ) are strategic and key to continued success, but also expose an organisation to long term risk, whether it is through a lease commitment, a financial structure in a property acquisition or merely a decision to refurbish an interior space.

Decision makers do not always have the necessary property skills and expertise to make informed decisions. This is where we saw the gap in the market – to use our experience and track record to provide tailored solutions.

In our first 12 months of operation we concluded a number of deals that helped to launch the company. Notable, we concluded a 12-year Nedbank corporate lease for a development of 22,000m2 in Gauteng, followed closely by a land sale in Cape Town that will result in a R250 student housing accommodation scheme. Our pipeline of opportunities sees us operating nationally and more recently we have opportunities in Africa and Saudi Arabia.

Q3: What are your plans for your business over the next five to ten years?

Our vision is to create long-term capital wealth and to become Africa’s leading property solutions company. Over the next five years we will focus on building a pipeline of opportunity with our clients, based on innovative property ideas, value and service.

Q4: What do you look for in a wealth manager?

We are still in our start-up phase and have invested our accumulated investment capital with Belmont Asset Management. Our goal was to find an innovative and experienced asset management team that is relationship driven and offers the highest levels of integrity. We also value an approachable and open-minded philosophy.

Q5: What are your long term investment goals?

To continue to invest in high quality shares that can be held over the long-term and to have a diversified portfolio, not only across different asset classes and sectors but also with rand hedge properties.

ARTICLE ORIGINALLY PUBLISHED IN 2013 | CAPE TIMES

R 130m expansion for Nelspruit shopping mall

NELSPRUIT’s Riverside Mall shopping centre is to be redeveloped by Old Mutual in a R 130-million expansion that will add a host of top retailers to the existing tenant mix.

“It is hoped to start construction within the next month to ensure completion of the redevelopment by October 2005,” said Brent Wiltshire, retail property executive of Old Mutual Properties.

The redevelopment will be undertaken by Old Mutual Properties.

“We expect the redevelopment to provide a substantial boost to the local economy. Jobs will be created in the short term in the construction phase among contractors and subcontractors and in the building supply industry and in the longer term by the retailers who will be opening stores in the expanded centre.”

Wiltshire said that the total rentable area of the Riverside Mall, which celebrates its 6th birthday this month, will increase from 36 287m2 to 49 529m2.

“This will see the addition of a 3 642m2 Checkers and 3 559m2 Edgars serving as anchor tenants in a ground-floor extension along with a Truworths emporium, Mr Price Weekend, @Home, Young Designers Emporium, and several line shops. Truworths and Mr Price will substantially expand their trading areas.

“The Pick ‘n Pay store, which has twice won the award of best-performing supermarket within the Old Mutual Properties portfolio, will be expanded by 1 282m2. Several of the smaller national retailers also require expansion.”

There will also be a new entrance to Woolworths and the parking will be extended to provide a total of 2 823 bays.

Wiltshire said the redevelopment would entrench Riverside Mall as the premier shopping centre in Mpumalanga, with the newcomers to the centre adding to the already strong tenant mix.

“The building programme will be tackled in such a way as to ensure that it is business as usual for our existing retailers and their customers visiting Riverside Mall. Our aim is to ensure a minimum of inconvenience during the construction phase.”

ARTICLE ORIGINALLY PUBLISHED 17 SEPTEMBER 2004 | ENGINEERING NEWS

SA malls up for international acclaim

Before you complain that the mall is too crowded next Saturday morning, it might be interesting to note that some of the reasons for their popularity are putting them on the international map. Or two of them at least: Gateway Theatre of Shopping at Umhlanga and Menlyn Park in Pretoria, are in the running for Maxi awards, the premier marketing honour of the International Council of Shopping Centres.

The council, the global association for the retail real estate industry has nominated four projects – two from each of the centres – as finalists for the 2004 Maxi awards, the “Oscars” of shopping centre marketing. The awards will be announced in September.

“This is the third year in succession that projects at the two centres have been chosen as finalists,” says Brent Wiltshire, retail property executive of Old Mutual Properties, which manages Gateway and Menlyn Park. “No other centre in South Africa has ever made the finals.”

The Gateway projects were the staging of shows featuring Barney, the popular children’s character, and hosting Africa’s longest breakfast table which raised R90 000 for the Reach for a Dream Foundation. At Menlyn Park, the projects gaining attention were the 10th annual Vukani fashion awards, and of Boktown, which brought the environment of a Springbok rugby test to shoppers.

ARTICLE ORIGINALLY PUBLISHED ON 01 SEPTEMBER 2004 | MARKETING MIX

Thousands gain new skills through multi-faceted service programme

THOUSANDS of men and women engaged in the portfolios of retail, commercial and industrial premises developed and managed by Old Mutual Properties, are gaining new skills through Imprint, a multi-faceted programme aimed at empowering them to deliver world-class service.

The SETA-registered was prompted by Old Mutual Properties’ drive to ensure that contact with staff and those service providers who manage company properties is synonymous with service excellence.

Brent Wiltshire, retail executive for Old Mutual Properties, says: “Imprint has its origin in our retail division where we go to great lengths to design and build shopping destinations for our clients that provide a unique and enjoyable experience. To ensure a place in which people feel comfortable to relax, interact and have fun requires a dedicated focus on the human component. This is where customer service comes in.

“It is our intention not only to enhance the service provided at our centres but that the people involved benefit from the training they receive in their jobs.

“We currently employ thousands of workers via our service providers and this programme means that each person has their personal approach enhanced. The programme addresses personal enhancement through a focus on life skills, nutritional intake and management of finances, including a look at products and services best suited to individual needs.

“Complementing this programme is an initiative which has seen smaller tenants in shopping centres receive consulting service on retailing. This service was first introduced as a landlord initiative to support small traders needing assistance through difficult periods, particularly in the early stages of a shopping centre’s life.

“The trust is on helping retailers improve their offerings according to the basics of retailing. Programmes for small retailers and individual store assessments will address any overall deficiencies in what our tenants have to offer.”

ARTICLE ORIGINALLY PUBLISHED 31 MARCH 2004 | CAPE TIMES

Big office move on Foreshore

THE eastern precinct of Cape Town’s Foreshore is set to register one of the larger office relocations in the area in recent years.

After 20 years in Broadway Centre on Hertzog Boulevard, BDO Spencer Steward is moving its growing accounting and business services practice into 2 400m2 at the former ICL House on the corner of Oswald Pirow Street from December 1.

The property was proposed by Viv Delbridge, of Corporate Real Estate Services (CRES) division of Old Mutual Properties. BDO managing partner Ian Scott says the building is being remodelled to to their specifications following its purchase by a consortium in a transaction jointly brokered by Delbridge and Dudley Annenberg of Annenberg Real Estate.

“We have grown from merely being an accounting practice into advisers to expanding and owner-managed businesses and needed more modern open-plan offices,” explained Scott.

“CRES highlighted the former ICL House to us as a potential solution, but we elected to pursue other alternatives. None of these were realised. We were then again approached by Viv Delbridge of CRES and Dudley Annenberg and opted for the move, given that parking would be built in and space remodelled to our requirements. The Foreshore offers good value and is close to public transport.”

Two floors of the seven-storey building are being revamped to house 50 parking bays. BDO Spencer Steward will occupy the top three floors and two others are being let.

ARTICLE ORIGINALLY PUBLISHED IN 2003

Gateway shoppers hit the 25 million mark

SINCE opening its doors in September 2001, Gateway Theatre of Shopping’s foot traffic has reached the 25 million mark.

Overall, the December 2002 shopper flow of 2.26 million was 1.1% less than December 2001, but with an increase of 10.4% in vehicle traffic. This increase in vehicle traffic was attributed to an increase in dedicated shopping trips.

Growth over December in 2001 was 15%, with several national retailers in the 25% to 40% bracket. Market research, undertaken in the two successive Decembers, reveals increasing loyalty to Gateway by Durban customers, and growth in the tourist market.

Research undertaken by Urban Studies revealed an increase in loyalty of 15%, with potential for this to further increase in 2003. The research feedback indicated a significant upwards shift in Gateway’s customer profile, together with a major increase in the tourist component.

Major points include a change in average customer income increasing from R16 000 to R23 500 spend per family increasing from R562 to R845. Tourists visiting Durban made up 31% of the customers, double the figure for 2001 of 15%, while international tourists increased from 1% to 3%.

As a result of positive market feedback, there is renewed interest in space, with 9% of the centre remaining vacant. Negotiations with two national chains are close to conclusion. Together, their ten stores will occupy in excess of 9 000m2, requiring an extension to the centre.

With several stores needing to be combined to facilitate this development, 60 vacant stores will still need to be let. it is anticipated the bulk of this space will year.

Brent Wiltshire, Old Mutual Properties national retail executive, said with its attraction of an average of 1.46 million visitors a month, Gateway takes the successful formula of mixing leisure, shopping and entertainment to a new level. Some 40% of its entire area is devoted to entertainment.

Research has indicated that night trading is taking increased prominence. This is in line with an international trend for 30% of moviegoers to make other purchases in the centres they visit.

ARTICLE ORIGINALLY PUBLISHED ON 02 APRIL 2003 | MERCURY